Tax computation worksheet 2020 excel. Enter the amount from Form IT-540B-NRA Line 11.

For more information on who is eligible for the premium tax credit see the Instructions for Form 8962.

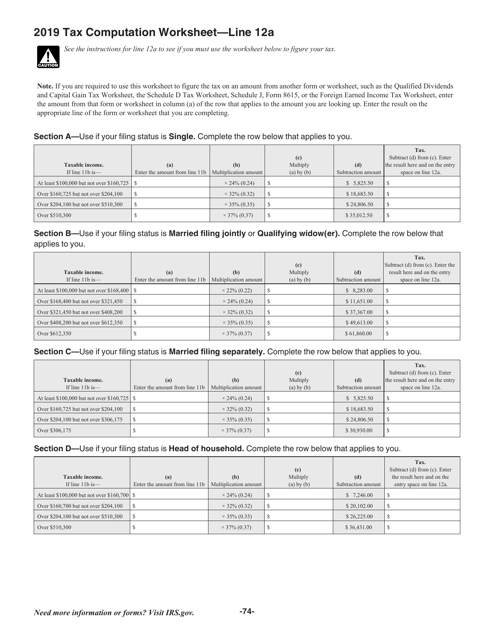

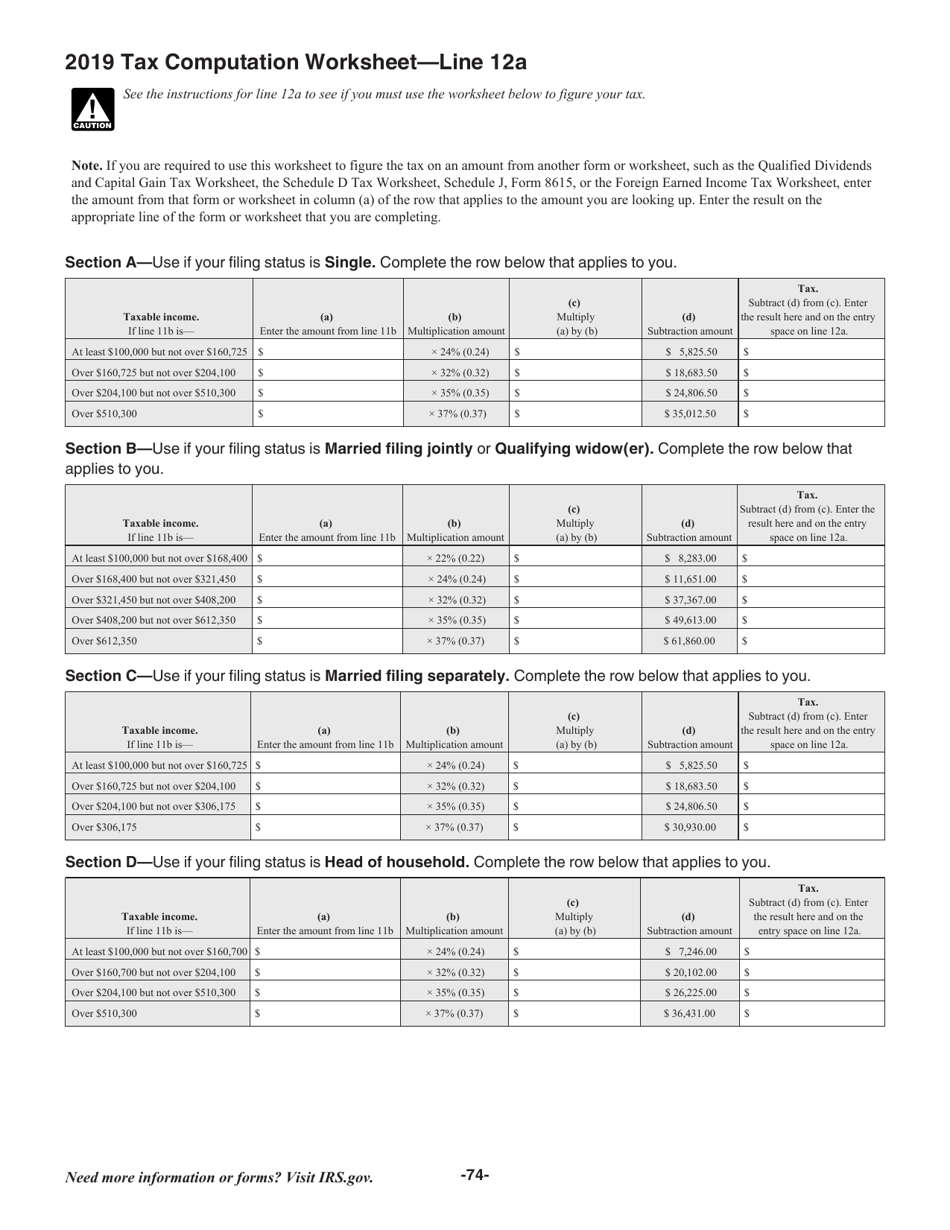

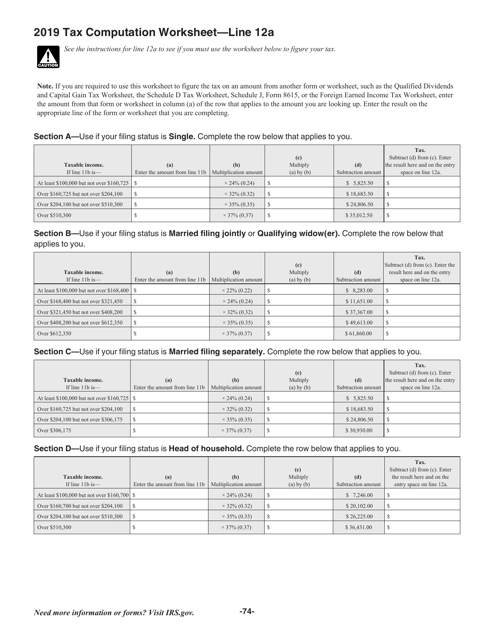

Tax computation worksheet 2020. If you are required to use this worksheet to figure the tax on an amount from another form or worksheet such as the Qualified Dividends and Capital Gain Tax Worksheet the Schedule D Tax Worksheet Schedule J Form 8615 or the Foreign Earned. The extended deadline also applies to making contributions to individual retirement arrangements and health savings accounts. Fuel acquired for eligible business use litres or kilograms Step 1 Business fuel use.

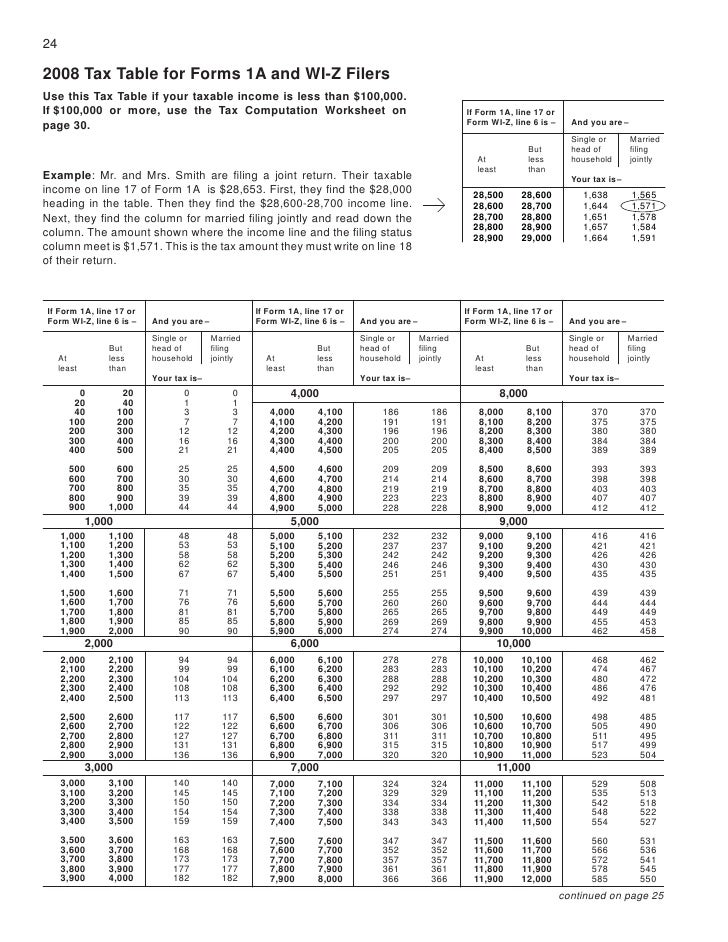

2020 04212021 Inst 1040 Tax Tables Tax Table Tax Computation Worksheet and EIC Table 2020 12182020 Inst 1040-C. A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax. If line 15 taxable income is And you are At least But less than Single Married filing jointly Married filing sepa-rately Head of a house-hold Your tax is 3000.

Displaying top 8 worksheets found for - 2020 Tax Computation. Tax Computation Worksheet for the 2020 taxes youre paying in 2021 can be used to figure out taxes owed. Worksheet 1-4 Tax Computation Worksheets for 2021.

Project the taxable income you will have for 2021 and figure the amount of tax you will have to pay on that income. Example of a completed fuel tax credits calculation worksheet BAS period 01042021 to 30062021. See the instructions for line 12a to see if you must use the worksheet below to figure your tax.

65250 148350 CAUTION. A 00 B First Bracket. Worksheet 1-5 Projected Withholding for 2021.

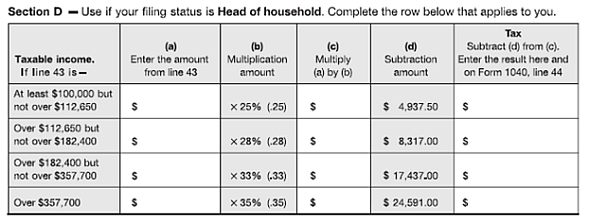

Worksheet 1-3 Projected Tax for 2020. ESTATE OR NONGRANTOR TRUST use this scheduleTAX BANKRUPTCY ESTATES use this scheduleTAX. Tax CompuTaTion WorksheeT keep this worksheet for your records a Taxable income.

Estimated tax payment due dates are not changed and the first estimated tax payment is due on April 15 2021. Fuel tax credit rate when you acquired the fuel cents per litre kilogram Use the rates Step 2 Fuel tax credit amount Amount must be converted to dollars. Some of the worksheets displayed are 2020 publication 17 2020 tax rate calculation work 2020 tax record work for Work a b and c these are work 2020 net Computation of 2020 estimated tax work Standard deduction and tax computation Tax computation work 2020 instruction 1040.

The premium tax credit for 2020 you don t need the information in Part II of Form 1095-C. RI-1041 TAX COMPUTATION WORKSHEET 2020 These schedules are to be used by calendar year 2020 taxpayers or fiscal year taxpayers that have a year beginning in 2020. Your Rights as a.

2020 Tax Table Continued. RHODE ISLAND TAX COMPUTATION WORKSHEET RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay--of the amount over 244688 639413 375 475 599 on excess 0 65250 148350. The deadline to file your 2020 Form 1040 or 1040-SR and pay any tax due on your 2020 return is postponed until May 17 2021.

Your Rights as a Taxpayer. 2020 Tax Computation Worksheet. Worksheet to calculate your tax payable.

Resident underpayment penalty computation worksheet underpayment of individual income tax penalty computation 2014 taxable year 2019 r 210r 1 20 underpayment of individual income tax penalty computation 2019 taxable year resident filers attach form r 210r to your form it 540 please print or type name as shown in the order on tax return social. How To Figure Your Tax. How To Get Tax Help.

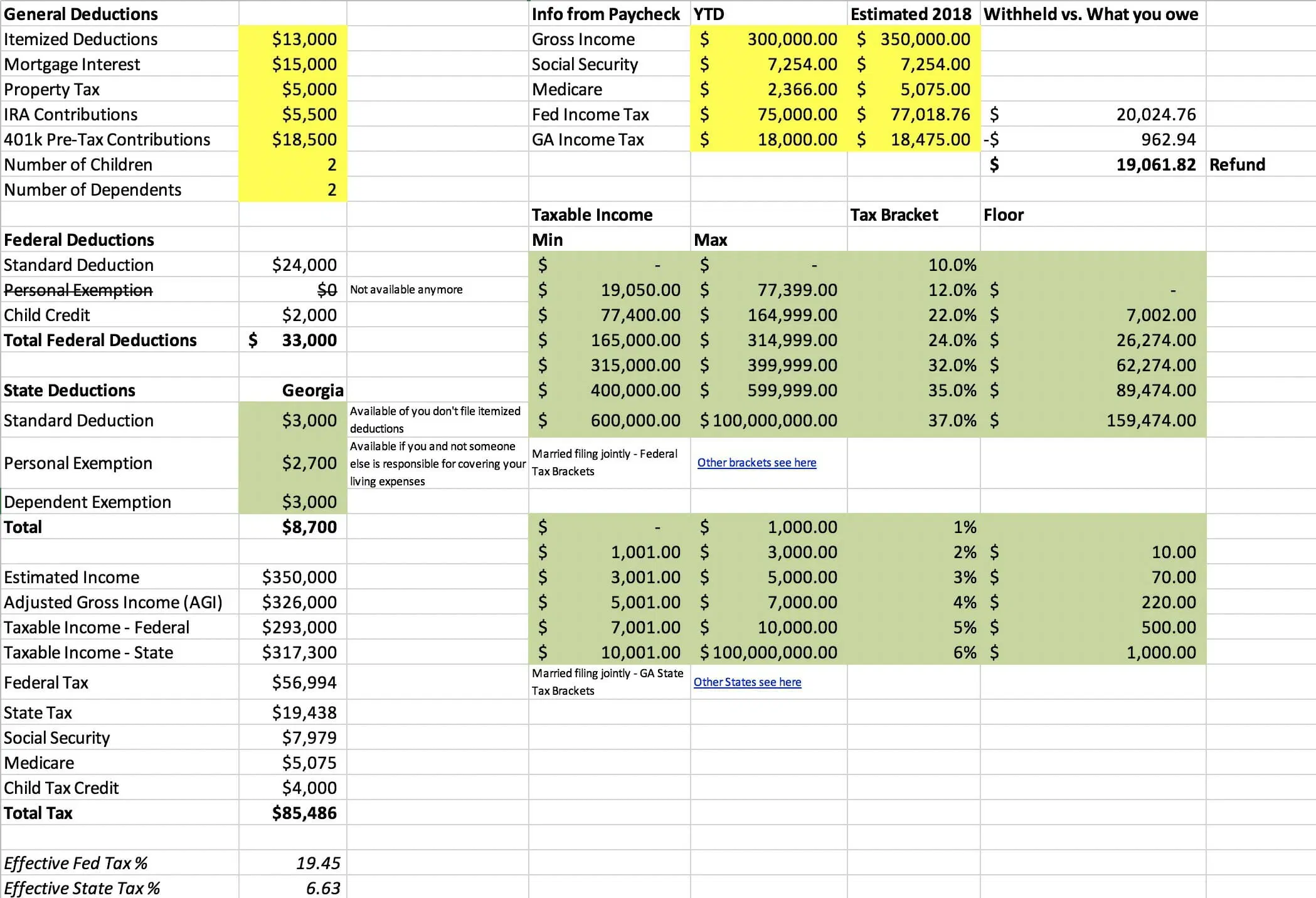

If Line A is greater than 12500 25000 if filing status is 2 or 5 enter 12500 25000 if filing status is 2 or 5. Showing top 8 worksheets in the category - 2020 Tax Computation. 20202021 Tax Estimate Spreadsheet If you are looking to find out if you will get a tax refund or if you owe money this year here is a simple Excel spreadsheet that can help you estimate federal and state income taxes before you file your return in 2021.

Those with less than 100000 in earnings can use the tax tables in order to figure out tax. 4 x 40000 160000. Instructions for Form 1040-C US.

The Rhode Island Tax Rate Schedule is shown so you can see the tax. The tax computation worksheet is for taxpayers with a net income of more than 100000. Project the amount of federal income tax that you will have withheld in 2021 compare.

2020 Tax Rate Schedules. Per year per week if weekly paid per month if monthly paid per fortnight if fortnightly paid tax credits rate band taxable pay 1 apply the standard rate of 20 to the income in your weekly rate band Another page will appear and show you your estimated tax liability. Companies should prepare their tax computations annually before completing the Form C-S C.

Some of the worksheets for this concept are 2020 publication 17 2020 tax rate calculation work 2020 tax record work for Work a b and c these are work 2020 net Computation of 2020 estimated tax work Standard deduction and tax computation Tax computation work 2020 instruction 1040. 2019 Tax Computation WorksheetLine 12a k. Line to file your 2020 Form 1040 or.

Only companies filing Form C need to submit their. Louisiana tax computation worksheet 2020. 3000 3050 303 303 303 303 3050 3100 308 308 308 308 3100 3150 313 313 313 313 3150 3200 318 318 318 318 3200 3250 323 323 323 323 3250 3300 328 328 328 328 3300 3350 333 333 333.

Tax adjustments include non-deductible expenses non-taxable receipts further deductions and capital allowances. Figure the amount of tax on your projected taxable income. If Line A is less than 12500 25000 if filing status is 2 or 5 enter amount from Line A.

B 00 C1 Combined. Child Tax Credit and Credit for Other Dependents. Departing Alien Income Tax Return 2021 01152021 Inst 1040-NR.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Form 1040 Download Printable Pdf Or Fill Online Line 12a Tax Computation Worksheet 2019 Templateroller

Irs Form 1040 Download Printable Pdf Or Fill Online Line 12a Tax Computation Worksheet 2019 Templateroller

On The Irs Tax Computation Worksheet What Does Column D Subtraction Amount Represent See Link For Reference Quora

The Tax Computation Worksheet Does Not Appear As A

Tax Computation Worksheet Fill Online Printable Fillable Blank Pdffiller

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Computation Worksheet Line 44 2016 Printable Pdf Download Best Tax Comput Comput Computat Computers Tablets And Accessories Dvd Unit Sales Tax

Tax Worksheet Kidz Activities Worksheet Template Tips And Reviews

Excel Formula Income Tax Bracket Calculation Exceljet

2012 Tax Computation Worksheet Fill Online Printable Fillable Blank Pdffiller

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Solved Use This Tax Computation Worksheet To Answer Exercise Calc Chegg Com

Income Tax Formula Excel University

How To Calculate Income Tax In Excel

Irs Form 1040 Download Printable Pdf Or Fill Online Line 12a Tax Computation Worksheet 2019 Templateroller

Filling Out 1040ez Video Tax Forms Khan Academy

Irs Tax Computation Worksheet Worksheets Ratchasima Printable Worksheets And Kids Activities Worksheet Template Tips And Reviews

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Post a Comment